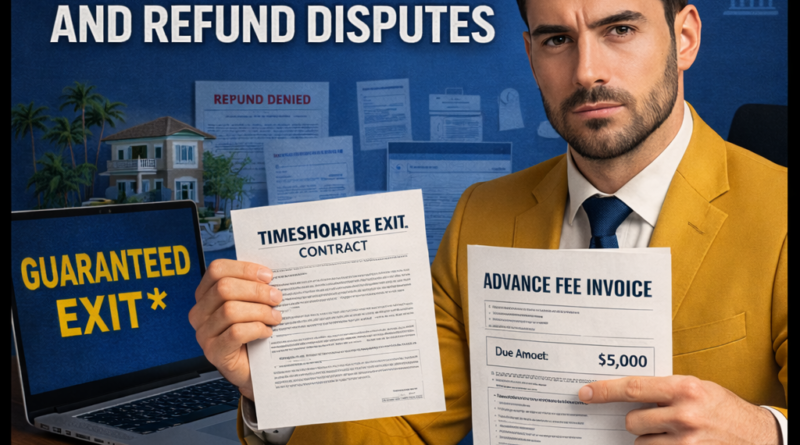

Timeshare exit advance-fee bans and refund disputes

Advance-fee “exit” offers can hide limits and exclusions, making timing and documentation critical for a fair dispute outcome.

Timeshare exit companies often promise a clean break from long-term obligations, but the billing structure can be the first problem. A large upfront charge may be presented as “processing” or “legal work,” even when the deliverables are vague, delayed, or tied to conditions that are hard to meet.

Disputes usually start when the consumer learns that fees were collected before meaningful services were performed, or that cancellation depends on steps the company never explained. The most practical way to reduce exposure is to understand how advance-fee limits work, what a compliant contract looks like, and what evidence supports a refund request.

- Upfront payments collected before measurable work is performed

- Marketing claims that overstate certainty, speed, or “guaranteed” release

- Contract fine print limiting refunds through timing or “completion” definitions

- Proof challenges when communications and deliverables are inconsistent

Quick guide to timeshare exit advance-fee bans and disputes

- What it is: A paid service promising to cancel, terminate, or “exit” a timeshare obligation.

- When it arises: Upfront fees are charged early, but the exit effort stalls, changes scope, or fails.

- Main legal area: Consumer protection rules, contract law, advertising standards, and telemarketing/solicitation regulations.

- Downside of ignoring it: Missed refund windows, weak chargeback evidence, and ongoing timeshare obligations.

- Basic path to seek a solution: Written demand and dispute process, complaints to regulators, and court or arbitration when needed.

Understanding timeshare exit advance-fee bans and disputes in practice

“Advance-fee” issues typically involve paying a substantial amount before the company completes defined milestones. A dispute is more likely when the contract does not clearly describe what counts as performance, how progress is measured, and when refunds apply.

In practice, the key question is whether the consumer received the service that was promised in the way it was marketed. That analysis often depends on the contract language, the sales presentation, and proof of what actually happened after payment.

- Fee structure: flat upfront payment, staged payments, or “retainer” with unclear scope.

- Deliverables: letters sent, negotiations attempted, filings prepared, or documented communications with the resort.

- Refund triggers: time-based windows, “work performed” definitions, or denial based on consumer cooperation.

- Marketing representations: “guarantees,” timelines, or claims of special legal authority.

- Clear milestones and dated deliverables carry more weight than general “efforts” language

- Sales calls and emails often define expectations more than the contract summary page

- Refund denials frequently cite “non-cooperation” or missed steps not clearly disclosed upfront

- Payment method (card, ACH, financing) affects dispute options and timelines

- Arbitration and venue clauses can change the strategy and cost of escalation

Legal and practical aspects of advance-fee rules

Advance-fee limitations can come from state consumer protection laws, timeshare-specific statutes, and rules that govern solicitations or telemarketing. Many jurisdictions require a written contract with specific disclosures and prohibit deceptive marketing practices, especially where success rates or “guaranteed exits” are implied.

Even where a strict “ban” is not universally stated, regulators often focus on whether the company took payment before providing meaningful, provable services. Courts and agencies also examine whether refund terms were prominently disclosed and consistent with the sales pitch.

Practical enforcement tends to turn on documentation: what was promised, what the consumer paid, what was delivered, and whether the consumer was misled about timing, eligibility, or the likelihood of release.

- Common compliance requirements: clear written terms, disclosures of limitations, and cancellation or rescission notices where applicable.

- Common timing issues: short cancellation windows, chargeback deadlines, and “service start” disputes.

- Typical decision criteria: material misrepresentation, unreasonable fee practices, and lack of documented performance.

Important differences and possible paths in timeshare exit disputes

Not all “exit” services are the same. Some position themselves as legal representation, others as consulting or document preparation, and others as marketing intermediaries. The label matters less than what the company actually does and how it is regulated in the relevant jurisdiction.

- Contract-based dispute: focuses on deliverables, timelines, and refund clauses.

- Misrepresentation-based dispute: focuses on sales claims, omissions, and misleading guarantees.

- Payment dispute track: card chargebacks or financing disputes tied to non-delivery or deceptive practices.

- Regulatory complaint track: complaints to consumer agencies or attorneys general when patterns appear.

Possible paths include an early settlement demand (fast and low-cost, but needs strong evidence), a contested process through arbitration or small claims/civil court (more formal and slower), and an appeal or renewed dispute if the first decision is denied (requires tighter documentation and clear timelines).

Practical application of advance-fee disputes in real cases

Common scenarios include a “guaranteed exit in 90 days” promise that turns into months of silence, a sudden request for additional fees to “accelerate the process,” or a claim that the consumer is ineligible only after payment is collected.

People most affected are those facing escalating maintenance fees, collection threats, or credit stress, and those who signed up after aggressive marketing. Disputes often hinge on documentation such as contracts, invoices, call recordings, chat logs, timelines of deliverables, and proof of contact with the resort.

Further reading:

Evidence should be organized around what was promised versus what was delivered, with dated items whenever possible. Generic statements like “work was done” are less persuasive than specific deliverables and verifiable communications.

- Gather the core file: contract, refund terms, invoices, marketing materials, and all communications.

- Create a timeline: payment date, promised milestones, actual steps taken, and any delays or changes.

- Send a written demand: request refund or adjustment citing specific misstatements and missing deliverables.

- Use formal dispute channels: card dispute/chargeback, lender dispute, or written complaint to relevant agencies.

- Escalate if needed: arbitration/court filing, or renewed dispute with added evidence after denial.

Technical details and relevant updates

Timeshare exit enforcement can shift as regulators target new marketing patterns, including social media ads, “limited-time exit programs,” and claims tied to consumer hardship. Where services are sold by phone, solicitation rules and disclosure obligations often become central.

Refund windows may be tied to contract rescission periods, payment network dispute deadlines, or specific contractual notice requirements. Missing the correct deadline can reduce options even when the underlying claim is strong.

Another recurring technical point is how the company defines “services rendered.” Some agreements treat a single template letter as completion, while marketing implies a full negotiation or legal process. That mismatch is a frequent trigger for disputes.

- Watch for clauses that define “completion” in unusually broad or vague terms

- Confirm whether arbitration, venue, or attorney-fee clauses apply

- Preserve screenshots of ads, guarantees, and claimed timelines

- Track all notices sent, including delivery confirmations

Practical examples of advance-fee disputes

Example 1 (more detailed): A consumer pays an upfront “retainer” after a sales call promising release from a timeshare within 120 days. The contract mentions “consulting services,” but the sales email includes a timeline and a statement that the company “handles the process end-to-end.” After payment, the only deliverable is a generic cancellation letter. No proof of resort contact is provided, and the company later claims the consumer must pay additional fees for “negotiation.” The consumer compiles the contract, the sales email, screenshots of the advertisement, and a timeline showing missed milestones. A written demand requests a refund based on mismatch between marketing claims and minimal deliverables. A parallel payment dispute is filed with the card issuer, attaching the evidence file and noting the lack of measurable performance. The likely outcome is a negotiated partial or full refund depending on the documentation quality and the dispute forum, without guaranteeing any specific result.

Example 2 (shorter): A company charges an advance fee, then denies a refund by claiming the consumer “did not cooperate.” The consumer provides proof of timely responses, requested documents, and follow-up emails, then files a complaint and dispute emphasizing that the cooperation standard was not clearly disclosed at sale.

Common mistakes in advance-fee timeshare exit disputes

- Paying large upfront amounts without a clear milestone-based scope and dated deliverables

- Failing to save ads, sales emails, and call notes that show what was promised

- Missing cancellation, notice, or payment-dispute deadlines

- Relying on phone conversations without written confirmation of key terms

- Sending vague refund requests that do not cite specific misstatements or missing services

- Ignoring arbitration/venue clauses until the dispute is already escalated

FAQ about timeshare exit advance-fee disputes

What counts as an “advance fee” in a timeshare exit service?

An advance fee is typically a payment collected before the company provides measurable, documented services tied to promised outcomes. Whether it is labeled as a retainer, enrollment charge, or processing fee, the practical focus is timing and proof of performance. The contract and the sales presentation both matter.

Who is most affected by disputes over these services?

Disputes often involve consumers facing rising maintenance fees, collection pressure, or urgent financial stress. They are also common when marketing implies guaranteed success or fast timelines. Cases tend to intensify when deliverables are minimal or when extra fees appear after the first payment.

What documents help most if a refund is denied?

The most useful documents include the signed contract, refund terms, invoices, proof of payment, advertisements, sales emails, and a timeline of promised versus delivered steps. Screenshots of guarantees and written proof of communications are especially helpful. Delivery confirmations for notices can also be decisive.

Legal basis and case law

These disputes are commonly evaluated under consumer protection principles that prohibit deceptive or unfair practices, along with contract doctrines that require clear terms and truthful representations. Many jurisdictions also impose disclosure requirements and specific rules for services marketed through phone or targeted solicitations.

In practical terms, the legal foundation often turns on whether marketing statements were material, whether limitations and refund rules were clearly disclosed, and whether the provider delivered what was promised. Where “success” claims are made, the provider may be expected to have reasonable support for those statements.

Court outcomes and enforcement patterns frequently emphasize proof: consumers tend to do better when they present a consistent record of the sales claims, the contract language, and the lack of documented performance. Providers tend to do better when they can show clear milestones met, detailed deliverables, and prominent disclosure of refund limits and conditions.

Final considerations

Advance-fee disputes with timeshare exit companies usually come down to clarity and evidence. When fee terms are vague or marketing overstates certainty, consumers can face delays, denials, and continued obligations even after paying significant amounts.

The most effective precautions are documenting promises, tracking deliverables against clear milestones, and acting quickly within applicable deadlines for notices and payment disputes. A well-organized file often changes the trajectory of a refund request.

This content is for informational purposes only and does not replace individualized analysis of the specific case by an attorney or qualified professional.

Do you have any questions about this topic?

Join our legal community. Post your question and get guidance from other members.

⚖️ ACCESS GLOBAL FORUM