FDIC/NCUA coverage planning for Arkansas accounts

Deposit insurance feels simple until multiple accounts, beneficiaries, and business funds get mixed under the same Social Security number or entity name. In Arkansas, the confusion usually shows up when families spread money across banks and credit unions, assuming the coverage “stacks” automatically.

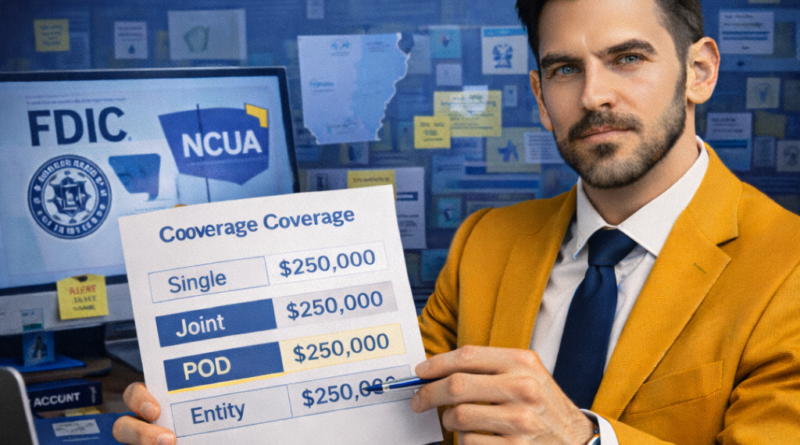

FDIC and NCUA coverage can protect eligible deposits, but the amount depends on how the account is titled, who legally owns the funds, and whether records clearly show beneficiaries and signing authority. A small naming or documentation gap can compress coverage and create avoidable exposure.

- Coverage limits may not “add up” if ownership categories are the same.

- Beneficiary mistakes can collapse POD coverage into single-owner limits.

- Business and personal funds can be misclassified without clean titling.

- Incomplete records can delay payouts and increase disputes after a failure.

Quick guide to FDIC/NCUA coverage and account titling strategies in Arkansas

- What it is: federal deposit insurance that protects eligible deposits at insured banks (FDIC) and credit unions (NCUA).

- When issues arise: when balances exceed standard limits, beneficiaries change, or accounts are opened under inconsistent names.

- Main legal area: consumer financial protection and banking compliance, plus estate planning concepts for beneficiary designations.

- Downside of ignoring titling: reduced insured amounts, payout delays, and disputes about ownership categories.

- Basic path to fix: audit account titles and owners, update beneficiary records, then confirm category-by-category totals with the institution.

Understanding FDIC/NCUA coverage in practice

FDIC and NCUA insurance is based on ownership categories and how deposits are held. The same person can have multiple accounts at one institution, but coverage is typically aggregated within a category rather than applied per account number.

Account titling matters because it helps determine the legal owner and the correct category. Titles should match the ownership reality: who owns the funds, whether the account is joint, whether it is a trust/POD setup, or whether it belongs to a business entity.

- Institution type (bank vs credit union) affects which insurer applies, but the coverage logic is similar.

- Ownership category drives aggregation across accounts at the same institution.

- Recordkeeping (names, SSNs/EINs, beneficiaries) is essential to obtain the intended category treatment.

- Beneficiary designations must be accurate and current to support payable-on-death coverage.

- Entity accounts should be separated from personal accounts to avoid misclassification.

- Confirm ownership category for each account, not just the account label.

- Standardize naming across all accounts (full legal name, consistent middle initial, consistent EIN usage).

- Document beneficiaries with full legal names and update after life events.

- Separate business funds under the entity’s EIN and correct entity title.

- Map totals per category at each institution before moving balances.

Legal and practical aspects of coverage determinations

Coverage determinations focus on who owns the deposit and the category recognized by the insurer. For example, single-owner accounts are typically aggregated together at one institution, even when spread across checking, savings, and CDs.

Joint accounts are generally aggregated as joint ownership interests, while certain trust or POD arrangements can be treated differently if beneficiaries are properly named and supported by the institution’s records. For business accounts, the key is whether the account is held by a separate legal entity and clearly documented as such.

- Account agreements and titles should match the intended ownership category.

- Tax identifiers should align with the owner (SSN for individuals, EIN for entities where applicable).

- Beneficiary records should be complete and readily verifiable by the institution.

- Authorized signers do not necessarily equal owners; the owner category drives insurance.

- Institution-by-institution aggregation means spreading funds can change coverage outcomes.

Important differences and possible paths in account structuring

Coverage planning differs depending on whether funds are held at a bank or credit union, and whether the deposit is personal, joint, trust/POD, or business-owned. The most common point of confusion is assuming that adding more accounts increases coverage within the same category at the same institution.

Common paths include (1) restructuring titling and beneficiaries to align with valid categories, (2) distributing deposits across multiple insured institutions when balances exceed category limits, and (3) formalizing entity or trust arrangements where appropriate. Each approach requires careful recordkeeping to avoid accidental category collapse.

Practical application in real cases

This topic often appears when a household receives a settlement, sells a home, inherits assets, or holds large operating cash temporarily. Another common scenario is a small business owner in Arkansas keeping payroll funds and personal savings in the same institution without clear entity titling.

Evidence and documentation usually includes bank or credit union statements, account agreements, signature cards, beneficiary forms, entity formation documents, and any trust documents tied to POD or trust accounts. Clean documentation helps confirm the correct category if an insurer reviews coverage after a failure.

- Inventory accounts at each institution, listing title, owners, SSN/EIN, and beneficiaries.

- Assign categories for each account and total balances per category at the institution.

- Fix record gaps by updating titles, beneficiary forms, and identifiers in writing.

- Rebalance funds across institutions or categories where totals exceed intended limits.

- Re-check annually and after major life events, business changes, or new beneficiaries.

Technical details and relevant updates

Coverage rules depend on the insurer’s definitions of ownership categories and the institution’s documentation. In practice, disputes often arise because internal records do not match the depositor’s intent, or because “doing business as” naming creates ambiguity over who owns the funds.

Further reading:

Another frequent technical point is the treatment of beneficiaries in POD-style arrangements. If beneficiaries are missing, incorrectly recorded, or not recognized as eligible for the intended category, coverage can be reduced to a simpler category with lower limits.

- Name consistency across accounts helps prevent record mismatches.

- Beneficiary updates should follow marriage, divorce, birth, death, or trust changes.

- Entity documentation should be retained and available if ownership is questioned.

- Temporary high balances deserve special planning when funds spike for short periods.

Practical examples of account titling strategies

Example 1 (more detailed): A married couple in Arkansas holds $700,000 at one insured bank across checking, savings, and two CDs. They assume each account has separate protection, but the balances are mostly in the same single-owner category under one spouse’s SSN. After reviewing titles, they restructure certain deposits into properly documented joint ownership and update POD beneficiary forms for specific accounts. They also move a portion to a second insured institution to keep totals within intended category limits, while maintaining clear records for each account type.

Example 2 (shorter): A small LLC uses the owner’s personal checking as an operating account. The business opens a dedicated account under the LLC’s legal name and EIN, keeps payroll and tax reserves there, and leaves personal savings in separate personal accounts. The clearer separation reduces confusion about entity ownership if the institution’s records are reviewed later.

Common mistakes in account titling and coverage planning

- Opening multiple accounts at one institution and assuming each adds new coverage.

- Inconsistent owner naming (nicknames, different initials, mixed identifiers) across accounts.

- Outdated beneficiaries after life events, creating record confusion and reduced category treatment.

- Mixing entity and personal funds without clear titling and EIN usage.

- Relying on verbal assurances without confirming category totals and written records.

- Ignoring temporary spikes after property sales, settlements, or inheritances.

FAQ about FDIC/NCUA coverage and account titling

Does opening more accounts at the same bank increase coverage?

Not necessarily. Coverage is commonly aggregated by ownership category at each institution, so multiple accounts can still be treated as one total within a category. The account title and ownership records determine how totals are grouped.

Who is most affected by coverage gaps?

Households with high balances, families using POD beneficiaries, and small business owners who keep operating cash in personal accounts are frequently affected. Coverage planning becomes more important when deposits temporarily surge or ownership is complex.

What documents help confirm the intended category?

Account agreements, signature cards, beneficiary forms, entity formation documents, and trust documents (when applicable) are common. Keeping consistent naming and updated beneficiary records helps the institution and insurer apply the correct category treatment.

Legal basis and case law

FDIC and NCUA insurance is governed by federal rules and insurer guidance that define ownership categories, aggregation logic, and recordkeeping requirements. In practice, these rules emphasize how the account is titled, how ownership is documented, and whether the institution’s records clearly support the category applied.

Although individual disputes can vary, coverage decisions tend to follow a consistent approach: where documentation is clear, the insurer applies the appropriate category; where records are incomplete or inconsistent, coverage can be treated more conservatively. This is why account agreements and beneficiary forms are often as important as the depositor’s intent.

Final considerations

FDIC/NCUA coverage planning in Arkansas is mostly about clean account titling, accurate beneficiaries, and understanding how category totals aggregate at each institution. Small documentation issues can compress coverage and create payout delays in high-balance situations.

- Organize records for owners, identifiers, and beneficiaries.

- Check category totals at each institution before moving funds.

- Update designations after major life and business changes.

This content is for informational purposes only and does not replace individualized analysis of the specific case by an attorney or qualified professional.